Let’s start with a basic structural x-ray of the situation of the sector and then go on to examine different aspects in more detail:

The glamping sector in the United States is a consolidated reality, proof of which is that 72% of the companies surveyed have been operating for more than 2 years and 35% for more than five years. This is a fact to take into account since, once the initial investment and the famous Reality vs Excel leap of the first few years have been survived, forecasts, investments and trends are much more accurate, giving this study a varnish of seriousness and practicality.

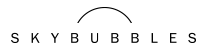

Currently the market we are dealing with is retail; 74% are sole proprietorships (one person) with only 13% corporations at the other end of the spectrum. This explains why 76% are single locations: it is easier and more manageable to have one location than to have several. But let’s not fool ourselves, anyone reading this who thinks of the typical resort with two cabins and a Dome managed and looked after by a retired couple is mistaken; the fact that most owners have a single location does not mean that the country is populated by small glampings… Far from it! The average number of rooms is no less than 11.3 per business; one location yes, but not small! Bungalow and cottage-type structure models prevail (more than 7 over the average of 11.3).

The most complicated thing in any service business is to get the right result of the equation that allows obtaining a good level of profitability while guaranteeing a good service. This means having a clear idea of the most costly item: personnel. Here the study provides us with two very powerful pieces of information: on the one hand, the companies surveyed have an average of 16 people working for the company, the vast majority part-time and 2 full time, as managers or directors; on the other hand, and in terms of profit, the average gross profit is $364,000, which ends up being equivalent to $161,000 net.

These figures are being achieved with an average price of $209/night, which, depending on the type of stay and season, varies between $105 and $300. It should be noted that 49% of the glampings claim to be open all year round and that the high season runs from April to September.

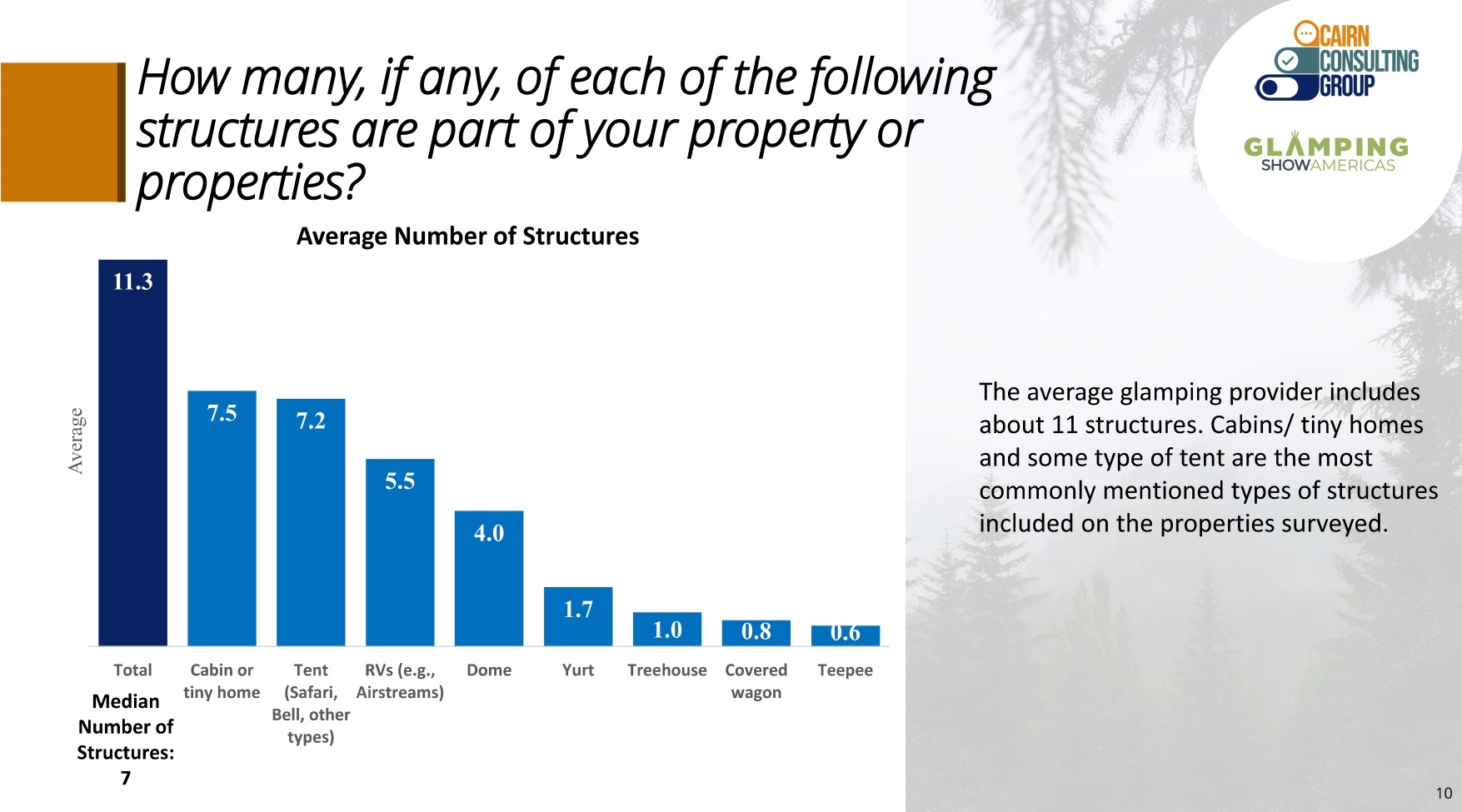

All start-ups have their complexity, in resorts there are two factors that are crucial to be able to lift the anchor and start invoicing: administrative permissions and financing. In these aspects, 61% of respondents said that they obtained the permits within 6 months of opening the business and 80% within the first year. To set up the resort, the average figure is estimated at $650,000, of which 93% of respondents said they had contributed all or a good amount of their savings. As the first provider of financing, banks appear as the most important, with a surprisingly tiny 34%, followed by different forms of financing such as seeking partners or investment rounds.

In the attraction and sale of the experience there is a clear winner, 98% of the resorts are committed to social media, mailing and digital ads, relegating offline to event sponsorship, public relations and radio and television ads. None of them exceed 30% of users. 54% of respondents say their marketing and sales actions are quite effective and 62% plan to invest more in marketing actions, especially digital, in the coming year. The customer target is mostly divided between couples (55%) and families with children (32%).

“61% of these new rooms are being built in a different category to those already on offer in order to differentiate themselves and provide a different experience… This again shows that the time for SkyBubbles has come! “

Finally, where do you think they plan to invest in the next three years? As the desire to increase annual turnover is around 30%, the owners plan to grow in new locations or put more rooms in the same location. Following the line that we told you at the beginning of the article, the thing is clear; glamping owners are betting on increasing the number of rooms rather than new locations, the ratio is 9 to 1. This is obvious given the investment effort and time that must be made to discover and launch a new resort. The interesting fact that comes out of this question is that 61% of these new rooms are being built in a different category to those already on offer in order to differentiate themselves and provide a different experience… This again shows that the time for Sky-Bubbles has come!

Any good summary must end with a conclusion; as a positive note of the report we highlight the maturity of the market and especially the speed of the start-up of the business, which is enviable in the USA. It also highlights the clear trend that sets the guidelines for the next three years and the firm commitment to growth. One aspect that could be improved is the role of the banks in financing so few projects in a consolidated market. This is often a symptom of the narrowing of risk parameters when assessing the granting of financing or the lowest interest rates. This is often a symptom of narrow risk parameters when assessing the granting of financing or of very high interest rates that discourage the option of taking out a loan.

The American Glamping market, far from sneezing, is in great health, so we can presage that the European market also has a great future ahead of it.